Kendall Ananyi on Investing in An African Unicorn – My Flutterwave Story

At the end of Q1 2021 Flutterwave announced their Series C funding led by Tiger Global and Avenir Growth Capital valuing the startup at a $1Billion making my 2nd Angel investment a Unicorn (Startup valued at a $1Bn).

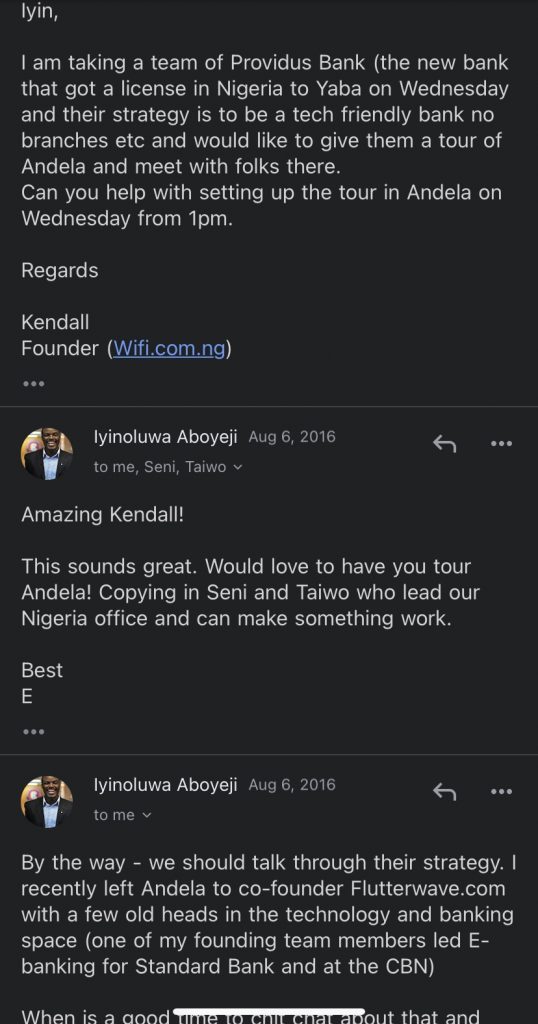

In August 2016, I led a team of Bankers looking to partner with startups to Yaba (center of Nigerian tech ecosystem at the time). I had emailed a number of Tech CEO’s informing about them about trip. I also emailed one of the founders of Andela so we could include a trip to Andela ‘s office as part of the itinerary. He wasn’t in town and instead told me about a new startup (Flutterwave) that he had co-founded. We agreed to catch up later.

We had a call and he informed me about his new payments startup, which (to me) was similar to Paystack which I had earlier invested in. I made a mental note to follow their progress because I had seen the amazing progress Paystack had made and was also excited that another startup had been accepted into Y Combinator.

Hedge

I was alone in my admiration back in August 2016 as other folks in Nigeria tech didn’t share my enthusiasm, multiple discussions popped up on Radar on the similarity between the 2 startups https://radar.techcabal.com/t/paystack-vs-flutterwave/8129/9. For me as an entrepreneur in the very competitive telecoms space, I had already learnt that Nigeria was a huge market and there was room for multiple businesses to be providing any service. Over the next 2 weeks my conviction grew as I followed the conversation and I emailed the co-founder to support their business with a small angel investment.

My thought process was instead of trying to figure out if they were competitors or whether the market was large enough for both of them or who would succeed, I should just invest in Flutterwave as a way to hedge my risk with my Paystack investment.

- If Paystack succeeded and Flutterwave failed, I am fine

- If Paystack failed and Flutterwave succeeded, I am fine

- If they both succeed, I am really fine

- If they both failed… well you should only invest what you are able to lose….tough luck.

I made the investment, was transparent with the founders of both startup about it so they could create a “Chinese wall” with any info/updates they wanted to share with me.

Diamond Hands

In July 2017 Flutterwave crossed $1Bn in transactions after being in business for a year. This was an amazing feat and they provided early investors the opportunity to exit. This was a rare thing for startup at the time. I had wanted to partially exit since it was a win, but in hindsight that would have been short sighted as few months later they announced their Series A round.

Their investor updates were always mind-blowing and they kept growing like crazy and people start to notice and wanted to be part of their story. Every couple of months since the initial opportunity to exit, there was someone reaching out to me wanting to buy Flutterwave shares via LinkedIn, cold emails, Whatsapp e.t.c. or asking for intro to the founders.

The more the requests came, the more I kept a longer time horizon on how long I was going to hold (or HODL in crypto speak) onto the investment.

The company was doing so well, they had the largest seed round, fastest Series B round, became a top YC company and there was no real reason to exit (Paper hands).

Unicorn

At the start of Q2 2021 Flutterwave announced they had reached unicorn status https://techcrunch.com/2021/03/09/african-payments-company-flutterwave-raises-170m-now-valued-at-over-1b/ .

I would not have had found out about the amazing opportunity if I was not “paying it forward” by connecting the bank to tech startups and thats the beauty of the tech ecosystem. I wish the Flutterwave team all the best, it’s amazing what they have achieved and they will even achieve more in the future. Next milestone $10Bn (Decacorn) 🙂

Your fore sight is amazing when it comes to the tech space in Nigeria. Kudos Kendall!!

It is such an inspiring story and it really shows that there is room for unicorons in Nigeria… Do you think Health Tech companies can have this type of growth ?

[…] I consider myself blessed and fortunate to have experienced exits, such as with Paystack, Flutterwave, Reliance Health Sharing the entire journey allows me to tap into the success of exceptional […]

[…] (Exited): Payment infrastructure for […]